2020/12/10 0:00:00

2020/12/10 0:00:00 2058

2058

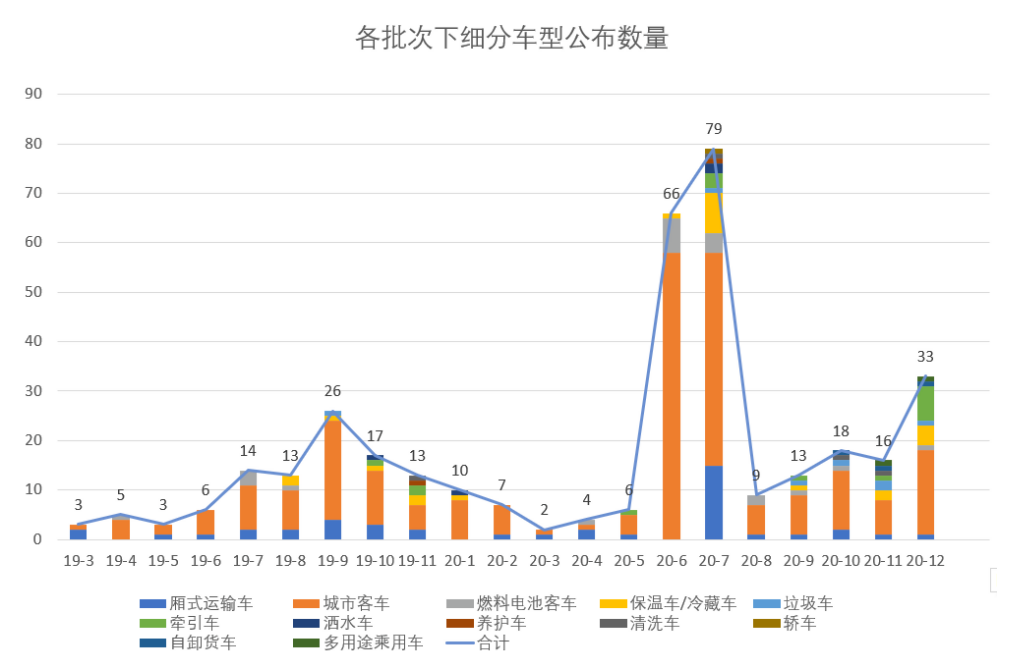

The year 2020 is coming to an end, and it is almost time to summarize the results of the year and plan for the work of the next year. On November 27, the Ministry of Industry and Information Technology announced the 338th batch of "Road Motor Vehicle Manufacturers and Products". So far, the number of vehicle models announced in 2020 has exceeded the number of batches for the entire year of 2019. Taking this opportunity, China Hydrogen Energy Network has compiled the "Recommended Models Catalog for the Promotion and Application of New Energy Vehicles" in the past two years, hoping to get a glimpse of the development law of my country’s fuel cell vehicle industry through the announcement of the Ministry of Industry and Information Technology, and provide the majority of hydrogen energy sources. The worker provides some reference.

In 2019, a total of 11 batches of the "Recommended Models for the Promotion and Application of New Energy Vehicles" were announced. Among them, the first and second batches of non-fuel cell models, and the remaining batches, all have fuel cell models. In the 12 batches of "Recommended Models for the Promotion and Application of New Energy Vehicles" announced in 2020, all fuel cell vehicles appeared. Even in the announcement batches during the epidemic, at least two fuel cell vehicles appeared. After the epidemic was basically controlled, the number of fuel cell announcements showed a blowout phenomenon. Some media friends even regard 2020 as the first year of China's fuel cell vehicle industrialization, which is not unreasonable.

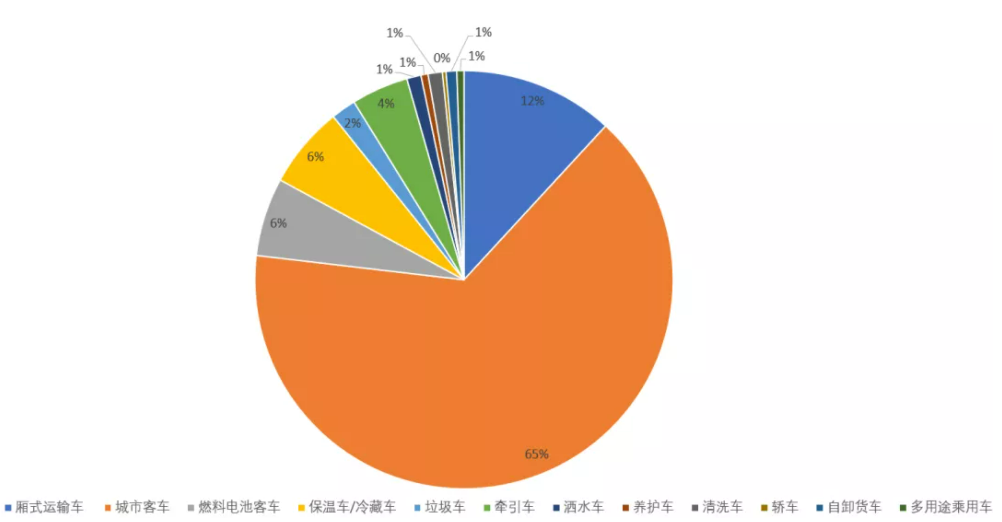

At the beginning of 2019, the announced models were mainly vans and city buses. In the 10th batch of 2019, tractors representing large trucks and special vehicles represented by sprinklers began to appear. After the 11th batch in 2019, the announced models began to bloom, and various models appeared. It can be seen that, as the main kinetic energy, the excellent feature of fuel cells that can be applied to various types of vehicles has been more and more widely recognized by OEMs. In the seventh batch of 2020, SAIC Motor has launched a fuel cell car, and its Chase company has also launched a fuel cell multi-function passenger vehicle. Throughout 2019 to 2020, city buses, which are completely subordinate to the public transportation sector, can easily receive subsidies, which account for the vast majority of all released models, accounting for up to 65%. The automobile city bus system has introduced a large number of fuel cell city buses. , Has played a good role in publicity for fuel cell vehicles. After years of hard work, fuel cell vehicles have finally been gradually accepted by the public, opening a new chapter in the "first year of fuel cell". The only regret is that the passenger models that introduced fuel cell vehicles into the public view due to Mirai have not received much attention in my country due to their technical difficulty and high cost. Since 2008, SAIC Motor and Tongji University have launched the "Exceeding After the series of models, there has been no major development of domestic fuel cell passenger vehicles for a long time.

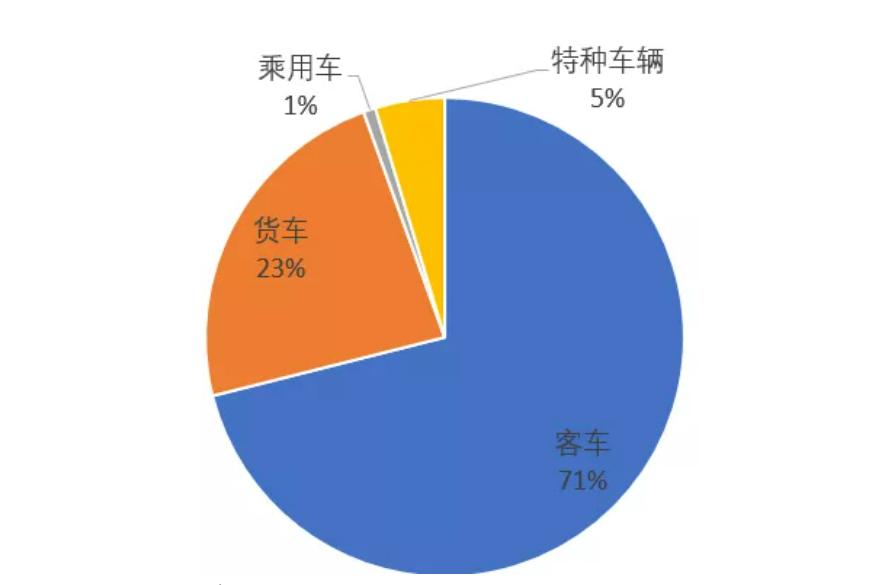

Through the analysis of the combination of vehicles, it can be found that the proportion of passenger cars, including city buses and long-distance buses, is as high as 71%, becoming the undisputed main category of fuel cell vehicles. Freight vehicles represented by detailed transport vehicles, tractors, and dump trucks also have nearly a quarter of the models. The special vehicles that began to appear in the second half of 2019 also accounted for 5%. In the past two years, passenger cars (including sedans and MPVs for multi-purpose passenger vehicles) have only appeared in three models, and there have been no announcements for SUVs in the domestic fire. Friends who have been paying attention to hydrogen energy for a long time can also find that passenger cars are the mainstream of fuel cell vehicles worldwide. The Toyota Mirai, which was mass-produced in 2015, has released the second-generation model as of September 2020. The Mirai has sold 11,154 units worldwide. Hyundai NEXO, the world's first fuel cell SUV, also sold more than 10,000 vehicles on July 12, 2020, reaching 10144 vehicles. Due to policy guidance, subsidies, cost, technology and other reasons, domestic manufacturers have not vigorously promoted fuel cell passenger vehicles, which has also made the majority of hydrogen energy enthusiasts unfortunately lost the opportunity to drive fuel cell vehicles.

The proportion of different types of models in all released models

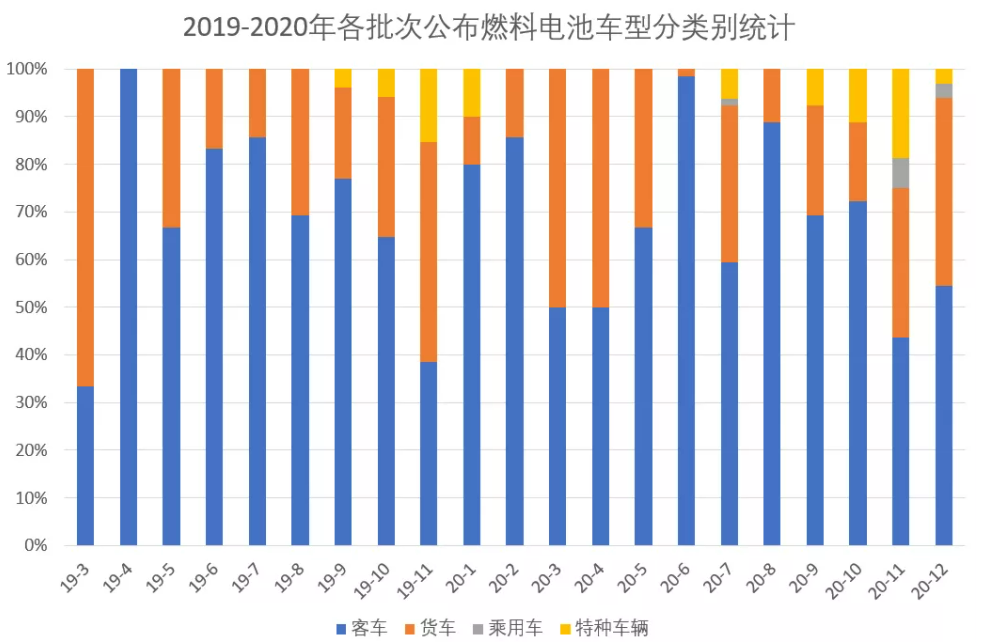

From the perspective of each batch, except for the third batch of announcements in 2019, the proportion of trucks is higher than that of passenger cars. At the same time, in the third and fourth batches of 2020, both trucks and buses account for 50%. In the second, passenger cars accounted for the main part. In the fourth batch of 2019, all models are passenger cars, and in the remaining batches, there are trucks. Special vehicles always appear in batches at the end of the year. This phenomenon may be related to the timing of municipal procurement planning.

Announcement of the percentage statistics of fuel cell models by category in each batch from 2019 to 2020

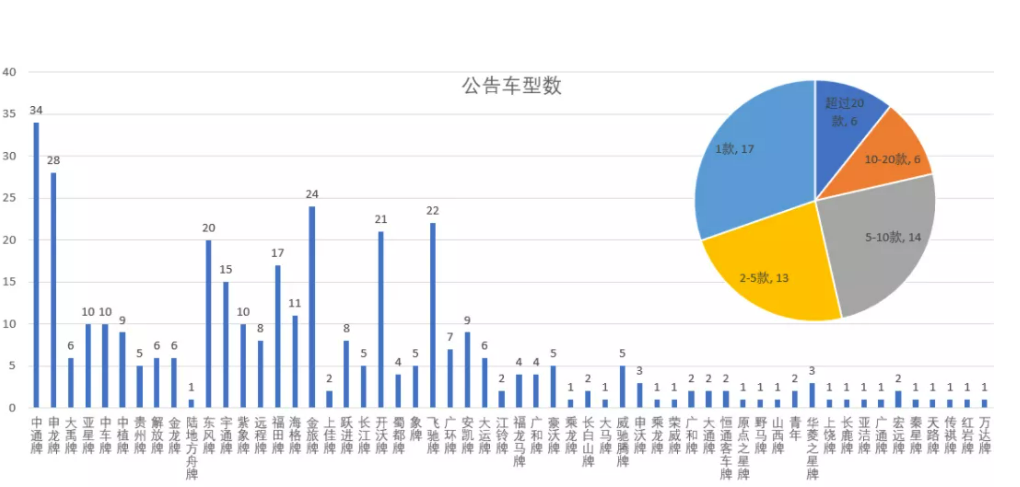

From the perspective of the brand of vehicle models, Zhongtong bus has won the top spot in the number of domestic "fuel cell" models with 34 models, followed by brands such as Shenlong, Dongfeng, Jinlu, Kaiwo, and Feichi with 20+ models. Generally speaking, there are 6 car brands that have released more than 20 models, 6 brands that have released 10-20 models of fuel cell vehicles, 14 brands that have released 5-10 models, and brands that have released 2-5 models. Of the 13, 17 brands have released only one model.

Summary of the number of models released by each brand

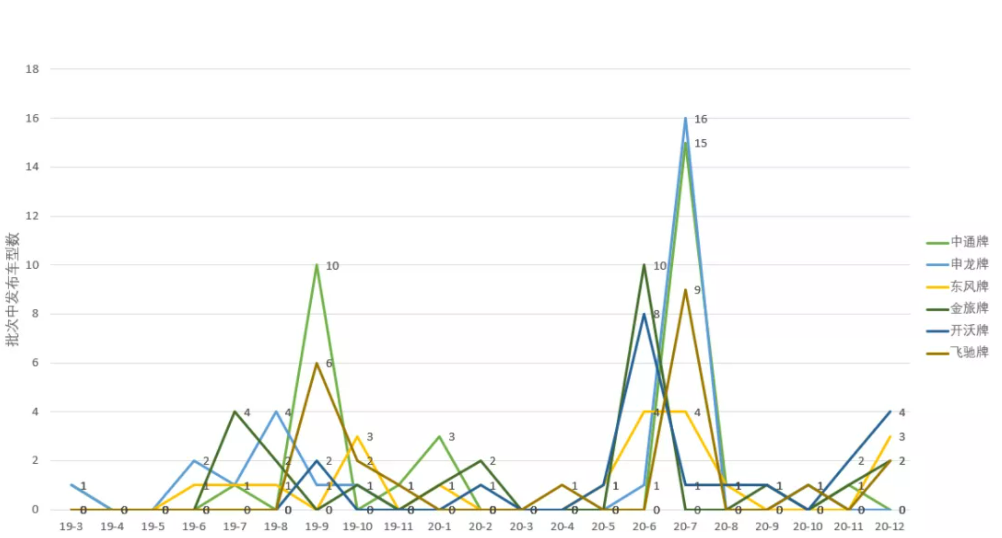

Observing the brands that have released more than 20 models, it can be found that ZTO’s models on the list are mainly concentrated in the 9th batch of 2019 and the 7th batch of 2020. In these two batches, ZTO has a total of 26 models on the list. It accounts for 76.5% of its models released in the past two years. The peak value of Feichi's models on the list is similar to that of Zhongtong, and it also appeared in the 9th batch of 2019 and the 7th batch of 2020. In these two batches, a total of 15 models were on the list, accounting for 68.2% of the total. . Shenlong's models are mainly concentrated in the 8th batch in 2019 and the 7th batch in 2020. In these two batches, there are 20 models of Shenlong fuel cell vehicles on the list, accounting for the brand's ranking in the past two years. 71.4% of all models. The peaks of Jinlu and Kaiwo cards on the list are concentrated in the sixth batch of 2020, slightly earlier than the other three, seizing the opportunity to announce the first big harvest after the epidemic.

The number of models released in each batch by brands with more than 20 models released in total

The core of a fuel cell vehicle is the fuel cell system, which is equivalent to the engine of a traditional car. Mastering the ability to develop fuel cell systems is equivalent to mastering the engine manufacturing technology of traditional fuel cell vehicles, which has an important impact on the core competitiveness of fuel cell vehicles. As an emerging industry, fuel cell system vendors have sprung up in recent years, and the market has gradually entered fierce competition. In this opportunity, which fuel cell manufacturer can get more orders, and which manufacturer will get a huge opportunity when the hydrogen energy society is built in the future. At the same time, which region can support more related enterprises can attract more professionals, occupy the high ground of fuel cell technology, and bring strong growth points to the local economy. Therefore, local governments have introduced relevant policies to support fuel cell system companies.

Compared with fuel cell companies in various provinces, Beijing, Shanghai, and Guangdong are worthy of the gathering place of China's first-tier cities. With the strong appeal of their cities, many high-quality fuel cell system manufacturers have settled down. At the same time, due to policy guidance and integration of industry, education and research, Hubei Province also has more fuel cell system companies and has become one of the country's hydrogen energy centers. With its own strength, Weichai Power has led Shandong to squeeze into the top five provinces for hydrogen energy development in the country.

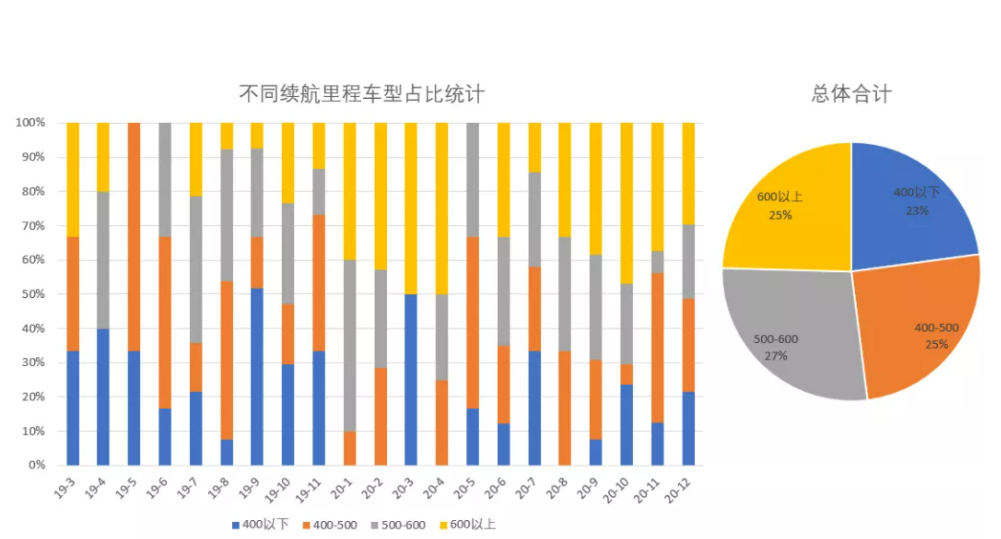

The cruising range is a major advantage of fuel cell vehicles compared to pure electric vehicles. Only by using a larger hydrogen storage tank, the cruising range of fuel cell vehicles can be effectively increased. In terms of subsidy policies, it is also a major advantage for fuel cell vehicles. There are relevant regulations on the minimum cruising mileage. Therefore, when the major manufacturers released their models, they all chose a cruising range of more than 300km. It can be seen from Figure 8 that, in general, the number of fuel cell vehicle models with various types of cruising range is relatively small. However, judging from the changes in each batch, the mileage above 600km has appeared more and more frequently in recent announcements. In recent announcements, there have even been models with a cruising range of 1100km (BAIC Foton Motor Co., Ltd. Foton brand BJ6116FCEVUH fuel cell bus), which shows that under the guidance of the policy, the long-term advantages of fuel cell vehicles are being paid more and more attention.

Statistics on the proportion of different cruising range models

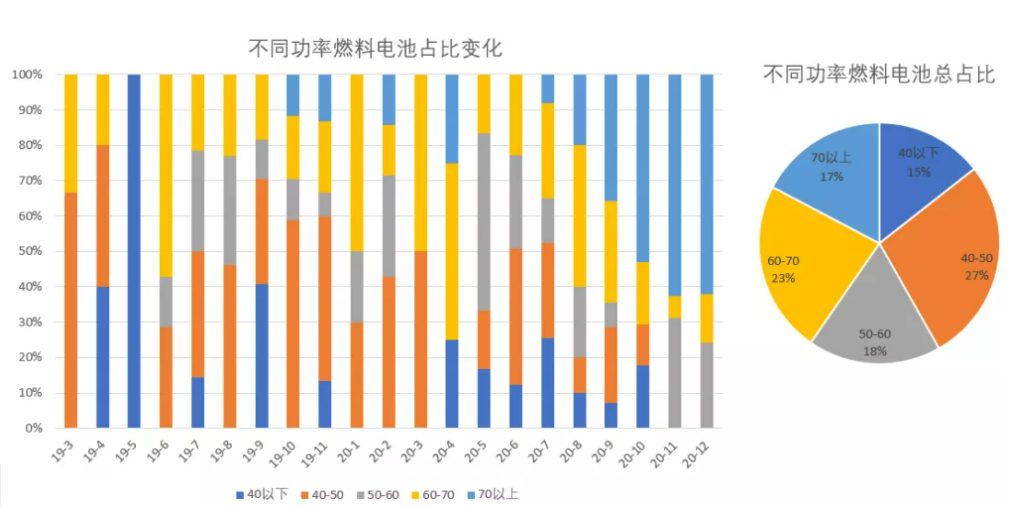

The last issue worthy of attention is the change in the rated power of the fuel cell. Due to the provisions of the subsidy policy and the cost of auxiliary accessories, fuel cell stacks below 30kw hardly exist in fuel cell vehicles. Generally speaking, most fuel cell system options are concentrated in the range of 40-70kw. However, with the release of the new fuel cell bonus policy on September 21 and technological progress, fuel cell stacks larger than 70kw are becoming more and more popular. As the low-power fuel cell system in the points reward policy will have a discount on the points obtained, the lower-power fuel cell system is disappearing. It may be limited to technical and cost considerations in 2019. Fuel cell systems of 60-70kw have appeared more in 2019, and in recent times, their proportion has been gradually compressed.

Changes in the proportion of fuel cells with different power

From the "Recommended Models Catalog for the Promotion and Application of New Energy Vehicles" in the past two years, it can be found that my country's fuel cell has really entered a blowout period, and more and more models have been announced on the list. Government-led transportation products such as city buses are currently full of fuel cell vehicles. Major automakers are turning their attention to fuel cells and exploring the various possibilities of fuel cell vehicles, so as to overcome obstacles and create a bright future for practitioners in the hydrogen energy industry. future.

Another exciting aspect is that the hydrogen energy and fuel cell industries are receiving government attention. First-tier cities such as Beijing, Shanghai, Guangzhou and Shenzhen, and major industrial cities such as Wuhan, Suzhou, Weifang, etc., are all vigorously attracting the landing of the hydrogen energy and fuel cell industries. Give relevant practitioners more choices.

The last thing we can see is the great progress of hydrogen energy and fuel cell technology. The fuel cell power and the vehicle's cruising range on the list are showing an increasing trend. Under the guidance of policies and the market, the outstanding advantages of fuel cell's long battery life and high power will be more effectively used to provide strong support for my country's green transportation and automobile industry.