2022/12/29 17:13:38

2022/12/29 17:13:38 17738

17738

Foreword

A pneumonia of unknown cause was found in Wuhan at the end of December 2019, marking the beginning of the epidemic era. The three-year fight against COVID-19 has passed quickly. With the release of the "10 new Measures" on December 7, 2022, China's COVID-19 response has entered a post-epidemic era. China has effectively coordinated the relationship between COVID-19 response and economic growth, social development and the bottom line, and short-term and long-term development, and found a way to coordinate economic development and epidemic prevention and control efficiently. In these three years, opportunities and challenges coexist. With the rapid growth of the industry, the acceleration of policy planning, the breakthrough of core technology and the improvement of infrastructure, the hydrogen industry obviously presented a gushing trend. Chinese governments and enterprises also accelerated the planning and layout of the hydrogen energy industry. All the spotlights are on the hydrogen industry, and the spark of hydrogen energy development in China has become a prairie fire.

1. Government policy guidance and support

Internationally, developed countries such as the United States and Japan have long attached great importance to the development of the hydrogen industry. Hydrogen energy has become an important strategic choice for accelerating energy transformation and upgrading and cultivating new economic growth points. In particular, the United States put forward the concept of "hydrogen economy" in the 1960s, placing the development of the hydrogen industry in an important strategic position. At present, the core technology of the global hydrogen industry chain is becoming mature, the production of fuel cell vehicles is rapidly increasing, the manufacturing cost is continuously decreasing, the construction of hydrogen energy infrastructure is obviously accelerating, and the regional hydrogen supply network is gradually established. As a result, the hydrogen industry is in a period of rapid growth.

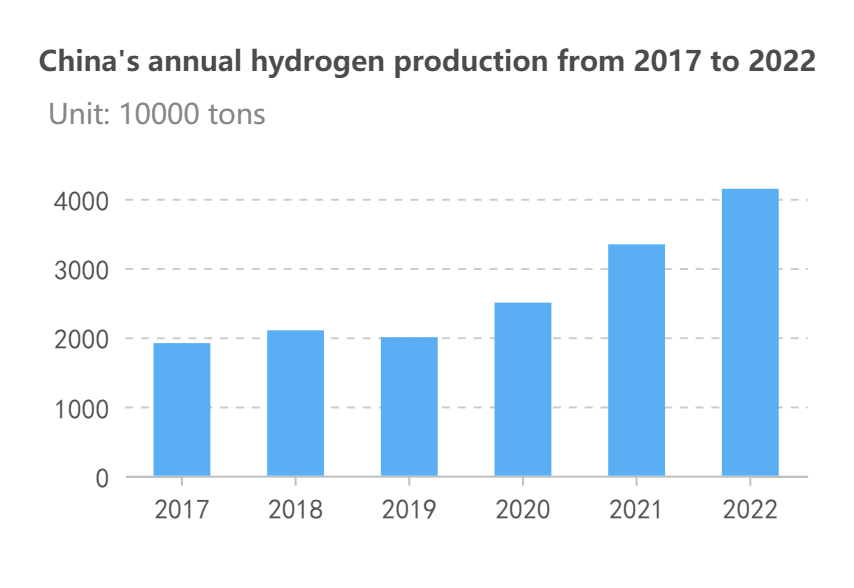

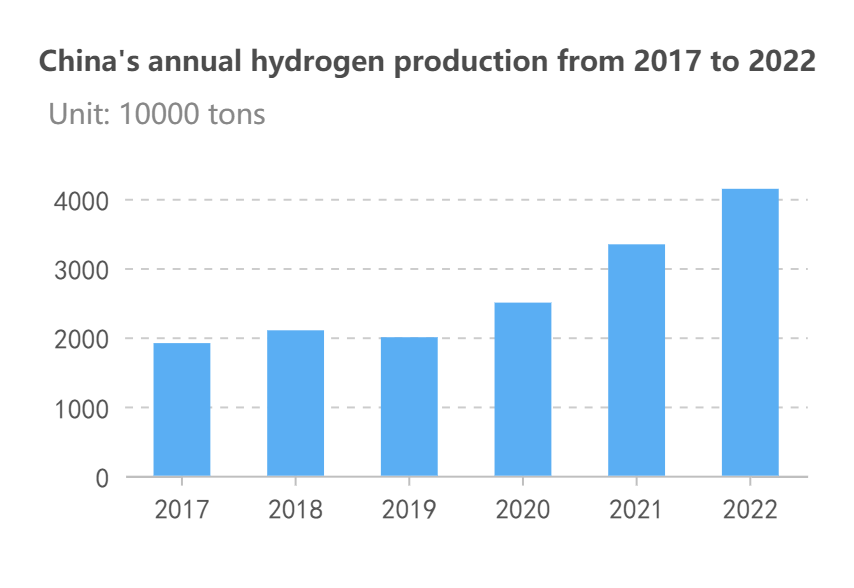

In China, the development of the hydrogen industry was still in the preliminary stage before 2019, and further exploration and attempts were still needed in terms of industrial innovation ability, technical equipment level, regulations and basic institutional norms supporting industrial development, and industrial development patterns and paths. However, the year 2019 is a turning point. With hydrogen production exceeding 20 million tons, China has become the world's largest hydrogen producer. In March 2019, hydrogen energy was included in the Report on the Work of the Government for the first time, calling for "promoting the construction of charging and hydrogenation facilities". This undoubtedly seemed to be a wave in the calm waters, and since then, the hydrogen industry has attracted the attention of the capital market. China, as a country with a strong hydrogen production industry, has an average annual growth rate of over 20% in hydrogen production from 2020 to 2022, ranking first in hydrogen production.

Figure 1. (Data source: author)

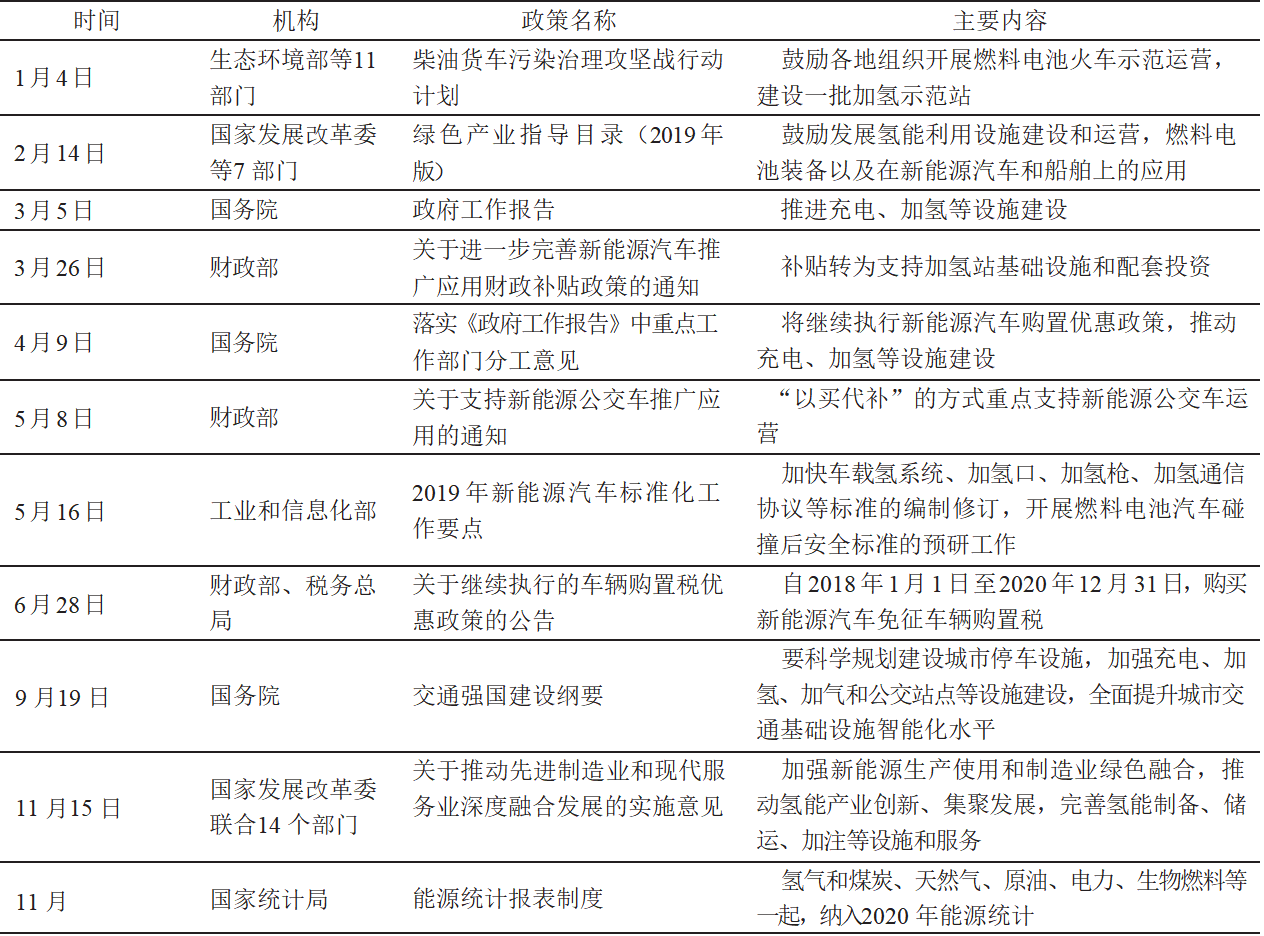

The rapid increase in hydrogen production is due to the continuous support of the national hydrogen industry policy and the favour of the capital market. China's hydrogen industry development policy in 2019 covers many areas, including infrastructure, equipment manufacturing and energy utilization, policy encouragement and financial support. At the same time, the guidance on hydrogenation infrastructure construction has been improved. Implementing relevant supporting policies and funds is conducive to solving the problems of hydrogen fuelling stations, such as large capital investment in the early stage and difficulties in operating safety supervision and approval. Therefore, the hydrogen industry has embarked on a fast growth track.

Table 1: Policies related to the development of China's hydrogen industry in 2019

In 2020, China's hydrogen policies were released more frequently, and support was further strengthened. In addition to the policies issued by national ministries, nearly 30 cities and regions have proposed their own planning goals for hydrogen or fuel cells. Furthermore, at the 75th session of the United Nations General Assembly in September 2020, President Xi presented for the first time that China would strive to achieve the goal of "emission peak and carbon neutrality". In December 2020, the specific "carbon peaking and carbon neutrality" goal was put forward: to build a new power system with new energy as the main body by 2030, and green and efficient development will become the future direction of China's energy system construction.

In March 2021, hydrogen energy was officially included in the draft of the 14th Five-Year Plan. In December, the 14th Five-Year Plan for Green Industrial Development proposed to speed up technological innovation and infrastructure construction of hydrogen energy and promote multiple utilization of hydrogen energy. In 2021, 28 national and local hydrogen-related policies were issued, including six nationwide and 22 in 11 provinces and municipalities. In general, Guangdong, Shandong, Shanghai, Zhejiang, Shaanxi, and Hebei issued more than one hydrogen energy-related policy in December, further enhancing the breadth and intensity of policy support and providing political support for the rapid development of the hydrogen industry.

By 2022, Chinese government ministries and commissions have issued several policies relating to the hydrogen industry, covering the four processes of upstream "production, storage, transportation and refuelling", midstream fuel cell power system industry and downstream vehicle manufacturing industry. As a result, the hydrogen industry has become a key development field during the 14th Five-Year Plan period. Under the goal of carbon peaking and carbon neutrality, hydrogen production from renewable energy and large-scale application of fuel cells will become one of the powerful ways to build a clean, low-carbon, safe and efficient energy system in China.

By March 2022, the National Development and Reform Commission and the National Energy Administration have officially released the Medium and Long-Term Plan for the Development of Hydrogen Energy Industry (2021-2035). The Plan formally established the three positioning of hydrogen energy in the future as an important part of the future national energy system, strategic emerging industries and key development direction of future industries, as well as an important carrier to realize green and low-carbon transformation with energy terminal. Since then, the whole country has reached a consensus at the policy level. Driven by national policies and the industrial environment, the hydrogen energy and fuel cell industries have gradually formed three major regions: Beijing-Tianjin-Hebei, Yangtze River Delta and Pearl River Delta. Due to different resources, industrial bases and technological advantages, each area has different priorities and paths for hydrogen energy development. Among the three key regions, the Yangtze River Delta region is ahead of the other areas of policy planning and industrial chain coverage. The Beijing-Tianjin-Hebei region mainly focuses on the demonstration application of hydrogen fuel cell commercial vehicles and the application and promotion of hydrogen energy. In contrast, the Pearl River Delta region primarily focuses on building a complete fuel cell industrial chain. The hydrogen energy industry has spread rapidly across the country.

Figure 2. (Data source: author)

During the three years of the epidemic, due to the introduction of relevant national policies and the " carbon peaking and carbon neutrality " goal, as well as the discovery of this new direction of economic development, the hydrogen industry was not affected as much as other industries. Still, it made steady progress relying on the support of policies. In general, with the gradual optimization of epidemic policies and relaxation of prevention and control measures, China's hydrogen energy industry will return to the track of rapid development. Therefore, the overall upward trend of the industry will not change, and the prospects are still broad.

2. the investment of diversified capital

Facing the potential development of the hydrogen energy industry, more than 40 central enterprises have been involved in the layout of the whole industrial chain, including production, storage, refuelling and application. Domestic energy enterprises, represented by state-owned enterprises and central enterprises, have accelerated their layout in the field of hydrogen energy. According to the global hydrogen energy review, enterprises have different priorities in hydrogen energy development, but their goals and plans are clear.

China Petrochemical Corporation (Sinopec) is one of the state-owned enterprises with the most stable and largest hydrogen energy business development. It has positioned hydrogen energy as the core business of new energy and is actively building China's largest hydrogen energy company. Considering the hydrogen industry's development stage and technical characteristics, Sinopec does not blindly invest in it but makes business deployment scientifically and accurately based on difficulties and key points. Sinopec has a business layout in the key technologies, equipment and materials of hydrogen energy production, storage, refuelling and application. More than that, Sinopec's ultimate goal is to establish an innovation and development platform for the hydrogen energy industry, support the construction of an emerging industrial ecosystem with a complete industrial chain, division of labour and common development, and achieve a new pattern of collaborative action.

China National Petroleum Corporation (CNPC), a big beast in China's oil industry, started its hydrogen energy business early in developing the new energy field. The announcement of the Medium and Long-Term Plan for the Development of Hydrogen Energy Industry (2021-2035) has accelerated the development of CNPC’s hydrogen energy business. Following the three-step strategy of "clean alternative, strategic replacement and green development", CNPC will develop hydrogen energy, gas resource and renewable energy in synergy and combine existing hydrogen production capacity and industrial by-product hydrogen production resources with carbon dioxide capture and utilization to achieve "blue hydrogen" supply. On June 5, 2022, CNPC released the " CNPC Green and Low-carbon Development Action Plan 3.0", which aims to occupy 30% of the domestic hydrogen supply market by 2050. This shows the ambitious goal of CNPC.

The hydrogen energy business of the State Power Investment Corporation Limited (SPIC) is mainly divided into two main lines: one is the product line, relying on the subordinate hydrogen energy company, the business covers materials to products and demonstration applications; The other is the energy line, which uses abundant renewable energy power resources and hydrogen production technology to build a hydrogen network in cooperation with partners. As the only comprehensive energy enterprise integrating hydropower, thermal power, nuclear power and new energy resources in China, SPIC has actively laid out a hydrogen energy business since 2020, focused on promoting the coordinated development of renewable energy power generation and green power hydrogen production, promoted the independent research and development and industrialization of renewable energy hydrogen production equipment and fuel cell related technologies, and steadily promoted the construction of hydrogen energy technology innovation demonstration project.

In 2022, with the accelerated development of the hydrogen energy industry, more and more large enterprises are accelerating their cross-industry development of hydrogen energy business, including Tencent, Huawei and other listed companies. According to incomplete statistics, since the beginning of this year, there have been Oriental Energy, Hongtao Group, Guangdong No.2 Hydropower engineering company, Hangzhou Oxygen Plant Group, Guanghui Energy etc. in the hydrogen industry. Listed companies adopt various ways, including establishing subsidiaries, industrial funds and other ways to layout the hydrogen industry, covering hydrogen energy applications, fuel cell materials and parts. The attention of the hydrogen energy industry in the capital market is gradually increasing, and more capital investment has brought new vitality to the hydrogen industry. The surge of concept stocks at the end of 2019 brought the whole society’s attention to hydrogen energy. Since then, the epidemic and policy changes have hovered hydrogen concept stocks for a year and a half. It was not until the implementation of the “carbon peaking and carbon neutrality" policy and specific measures in 2021 that the hydrogen concept stock returned to normal, allowing capital to invest more comprehensively. 2022 will be a historic year for the hydrogen industry. The introduction of national policies, the scientific planning of local governments and the acceptance of the capital market have undoubtedly found a rapid development path for the hydrogen industry.

3. Talent cultivation and technological innovation

As a frontier in the energy field, hydrogen energy is insufficient in technology and talent, mainly because there are few professional counterparts, and the degree of expertise is difficult to meet innovation and development needs. Most of the employees majored in chemical engineering, process and mechanical engineering, material science and engineering, thermal energy and power engineering, electrical engineering, and automation. On the one hand, there is a lack of experienced talents, which requires enterprises to cultivate independently, and the process is relatively long; On the other hand, there are few college graduates with corresponding majors, so enterprises need to recruit from other majors for training. Facing the problems above, gathering and cultivating industrial talents is urgent, especially the training and cultivation of hydrogen energy professionals.

In 2022, the Ministry of Education issued the “Work Plan for Strengthening the Construction of Carbon Peak and Carbon Neutral Higher Education Personnel Training System” (hereinafter referred to as the Plan), which called for accelerating the construction of disciplines related to energy storage and hydrogen energy. In the important task of "accelerating the cultivation of talents in shortage", the Plan puts the acceleration of the construction of disciplines related to energy storage and hydrogen energy in the first place in the carbon-peak and carbon-neutral field. It also points out that large-scale renewable energy consumption should be taken as the goal to promote colleges and universities to accelerate the cultivation of talents in energy storage and hydrogen energy to serve the demand for large-capacity and long-cycle energy storage to realize the coverage of the whole chain.

In fact, China's hydrogen energy technology reserves are insufficient, the industrial base is relatively backward, and the differences between different regions are obvious. Most of the technologies and talents are concentrated in the hot spots of the hydrogen industry, and most regions do not have the ability and conditions to bring the technical equipment to the market. There is still a big gap between some key parts and technologies of China's hydrogen energy industry and those of the most advanced foreign countries. The key elements and components still need to be imported, and foreign countries monopolize some key technologies. On the other hand, we are also pleased that more platforms, colleges and universities, alliances and industrial chains have gathered, more hydrogen energy research technology centres have been set up, which have gradually provided learning and research assistance for talent support, and the hydrogen energy industry talent training system has become increasingly perfect.

According to Japanese media, Japan leads the world in hydrogen patents, with 34,624 filed in the past decade. China has 21,235 patents, ranking second in the world. According to Japanese media, although Japan still ranks first in the world regarding the number of hydrogen patents, the number of new patent applications is declining, while China is rising. If this trend continues, China is likely to overtake Japan in the number of hydrogen patents. In the four key technologies of hydrogen energy, hydrogen production, storage, transportation and safety issues, China has surpassed Japan in the number of patents. Safety is the most critical issue for promoting and applying hydrogen power, which cannot be used on a large scale without solving it. In this respect, Chinese technology has surpassed Japan. Therefore, in the next few years, we will see the large-scale commercial use of China's mobile hydrogen storage technology and show a rapid development trend.

Technology and talents occupy the core position in the energy industry, and talent development should be based on the actual development of the hydrogen energy industry. Therefore, it is necessary to make a good plan for talent development in the hydrogen energy industry: strengthen the coordination and support among the government, enterprises, universities and industries, keep up with the pace of industrial development, and comprehensively increase the cultivation, introduction and use of talent in the hydrogen industry, to lay a solid foundation for the rapid growth of the hydrogen industry with a good talent environment.

4. Steady improvement in production and construction

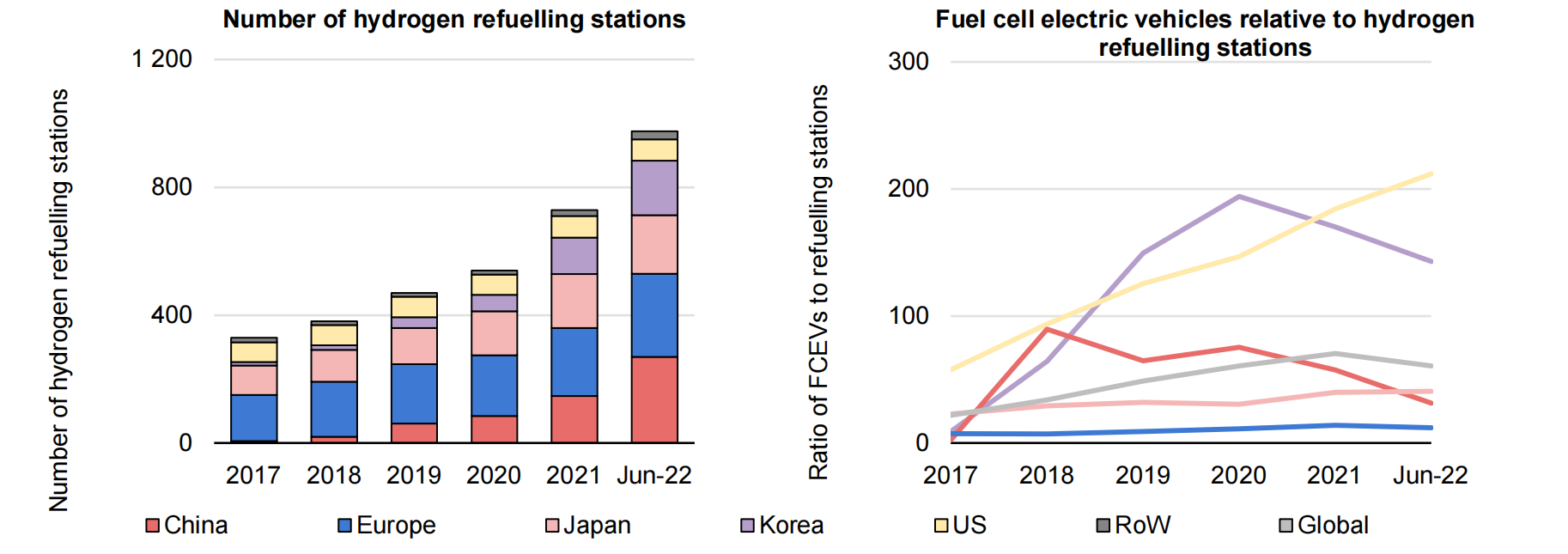

Hydrogen fuelling station plays an important role in the hydrogen industry chain as a bridge connecting hydrogen production and hydrogen use. Through the distribution and operation of domestic hydrogen fuelling stations, we can see part of the development of the domestic hydrogen energy industry. In 2019, the construction of hydrogen fuelling stations in China did not slow down due to the epidemic. All the capitals want to take advantage of the construction of hydrogen fuelling stations to seize market share and seek benefits for the next stage of energy development. However, a new problem appeared in 2022. From January to November, 40 hydrogen fuelling stations were built in China. Due to the impact of the epidemic and other factors, the speed of the construction of stations slowed down significantly compared to last year, and it is unlikely that the total number of stations built in 2022 will exceed that in 2021. In 2020, 553 hydrogen fuelling stations were built worldwide, mainly in Europe and Asia. In 2021, China, Japan and Germany ranked top three in terms of the number of hydrogen fuelling stations in the world, with 183, 157 and 92, respectively, accounting for 27.8%, 23.8% and 14.0% of the global total. In the future, the number of hydrogen fuelling stations worldwide is expected to increase rapidly between 2023 and 2030, based on the construction plans of major countries.

Figure 3. (Source: IEA, 2022)

The mobile hydrogen supply system is the application scenario of the mobile terminal of hydrogen energy and an important way of commercial use of hydrogen energy. According to the market size of mobile hydrogen supply systems in 2019-2022, the hydrogen fuel cell industry has a broad prospect. A "3+2" fuel cell vehicle demonstration city cluster consisting of Beijing, Shanghai, Guangdong, Henan and Hebei has been formed. Driven by national policies, enterprises are increasing their efforts in tackling key materials and core components of hydrogen fuel cells. Currently, the mobile hydrogen supply system is mainly faced with cost and technical problems. The direct reason is that some automobile enterprises will specify some parts of the mobile hydrogen supply system to use the products of foreign manufacturers; The root cause is the low degree of localization of parts of the mobile hydrogen supply system, which cannot fully meet the market demand, and the cost reduction is difficult. The domestic mobile hydrogen supply system has had an important development in 3 years. With the expansion of the valve market of the mobile hydrogen supply system, the above situation has gradually changed. Domestic enterprises have achieved different degrees of breakthroughs in valve technology and launched a competition to the market occupied by foreign brands. Technology and products continue to be localized. Their market share continues to expand and will further promote the innovation of the end of industry fuel cell. In the longer term, new energy vehicles will also be beneficial.

Figure 4. (Source: author)

5. Multi-industry integrated development is the future

The integration of the hydrogen industry has never been a difficult issue. As renewable energy with zero carbon emission, hydrogen energy has a wide range of terminal industry options. According to the forecast, by 2050, hydrogen energy will account for 10% of the terminal energy consumption, the number of hydrogen fuel cell vehicles will be 30 million, hydrogen demand will be 60 million tons, and people will enter the hydrogen society. By 2060, China's demand for hydrogen energy is expected to reach 130 million tons, of which industrial demand is dominant, accounting for about 60%. The transportation sector will expand year by year to get 31%.

According to data released by the Beijing Winter Olympics Organizing Committee, more than 1,000 hydrogen fuel cell vehicles equipped with more than 30 hydrogen fuelling stations have been demonstrated in this Winter Olympics, making it the largest single demonstration of fuel cell vehicles in the world. As the number of fuelling stations increases and the cost of hydrogen and fuel cells decreases, more fuel cell vehicle applications will be supported, further accelerating the market expansion. China has conducted demonstration operations in regional application scenarios such as public transport, urban logistics, and urban management service vehicles. In addition, the world's first 136-ton coal mine dump truck of Inner Mongolia North Hauler Joint Stock Co., Ltd. (hereafter NHL) with hydrogen fuel and lithium battery hybrid power is expected to roll off the production line at the beginning of 2023. It is equipped with industry-leading proton exchange membrane fuel cells and the 70MPa high pressure and large capacity on-board hydrogen storage system provided by Shanghai Sunwise Systems Co., LTD., which is another attempt to utilize hydrogen energy on heavy trucks.

On the other hand, hydrogen energy has a promising future in energy storage. The initial development of wind power is mainly concentrated in the "three-north" area, and the local economic development level is insufficient, the power demand is not exuberant, consumption space is relatively limited, and more wind power resources are wasted. At the same time, the construction of the national grid lags behind the development speed of wind power resources, which greatly impacts the export of wind electricity, resulting in the spatial mismatch of wind power production area and consumption area. Hydrogen production by wind electricity provides a direction to solve this problem. Energy can be stored by producing hydrogen from excess wind power resources to achieve energy conversion. Wind power-producing hydrogen is beginning to get attention worldwide, and our country is also speeding up the development and planning of wind power-producing hydrogen research. Due to the great challenges in the approval policy and economy of wind power hydrogen production in China, there is no mature commercial wind power hydrogen production system. Still, some companies have started the first wind power hydrogen production. Hebei Guyuan wind Power hydrogen production Project, with a total investment of 2.03 billion yuan and a yearly hydrogen capacity of 17.52 million standard cubic meters, is invested by HCIG New-Energy Co., LTD., and is the first wind power hydrogen production project in China. Wind power hydrogen production can not only solve the problems of wind power but also reduce the cost of hydrogen production and promote the upgrading of wind power and the hydrogen energy industry. All countries in the world are competing to formulate hydrogen energy development strategies. Hydrogen production by wind power is significant to China's energy substitution.

On the one hand, hydrogen energy industry integration promotes the development of hydrogen energy itself. On the other hand, it also plays an important role in the stage of multi-industry integration. The integrated development of multiple industries is the general trend. On December 15, 2022, the General Office of the State Council issued the 14th Five-Year Modern Logistics Development Plan, which pointed out: 1. Promote the development of green logistics: deeply promote the energy conservation and emission reduction in the logistics field and strengthen the supporting layout and construction of charging piles, hydrogen refuelling stations applicable to freight vehicles, shore power facilities applicable to inland ships, and LNG filling stations. Accelerate the application of new energy and freight vehicles meeting the national six emission standards in modern logistics, especially in urban distribution, and promote the application of new energy forklifts in warehousing. 2. Implementation of a green and low-carbon logistics innovation project: actively expand the application of new and clean energy such as electricity, hydrogen energy, natural gas, and advanced biological liquid fuels in transportation, warehousing, distribution and other links. Accelerate the establishment of clean energy supply and refuelling systems such as natural gas and hydrogen energy.

It is an important direction for future hydrogen energy development to closely combine hydrogen energy with renewable energy, construction, transportation, industry and other fields through various modes and explore the method of efficient operation and development of hydrogen energy. Hydrogen energy can be distributed and resupplied flexibly to meet energy demands in other fields. Using hydrogen energy as a key energy carrier to realize flexible and complementary allocation of various industrial resources can realize long-term development and wide utilization of hydrogen energy.

Conclusion

In 2022, the important position of hydrogen energy in China's energy industry has been confirmed. The country is accelerating the overall planning of hydrogen energy, and the hydrogen industry has gained unprecedented development opportunities. As many experts and scholars believe, hydrogen energy is an industry without a recession. In the three years of the epidemic, the hydrogen energy industry did not stagnate but seized the opportunity to rise against the trend. Although the epidemic had an impact, it didn’tchanged the overall growth trend.With the vigorous development of the hydrogen energy industry, we can also boldly predict that the future will be the world of hydrogen energy.

Hydrogen is undoubtedly the future of energy.

References:

Baorongtoutiao. (2022). The world's first 136-ton hydrogen-powered mining vehicle with zero emission and zero pollution is coming off the production line. [Online]. [Accessed December 26 2022]. Available from: https://mp.weixin.qq.com/s?__biz=MzI1NzIxNDIzNg==&mid=2247558136&idx=1&sn=866c3ed73c0f5a449f124908e308a738&chksm=ea19718bdd6ef89d5e3627d722d3014a633f7e5d4a403df23c894e94caf5f07b4ed3764d7695&scene=27

Beijing Century. (2022). Interpretation and Prospect -- Medium- and Long-Term planning of hydrogen industry development. [Online]. [Accessed December 26 2022]. Available from: https://baijiahao.baidu.com/s?id=1737519164158126063&wfr=spider&for=pc

Energy Research. (2022). Three years after the epidemic, the hydrogen energy industry has taken off with ups and downs. [Online]. [Accessed December 26 2022]. Available from: https://mp.weixin.qq.com/s/GyvFRqliT5ficZfYISpyDQ

Global Hydrogen Energy. (2022). "Three Barrels of Oil" 2022 Green Hydrogen Competition: Fully open the hydrogen energy layout. [Online]. [Accessed December 26 2022]. Available from: https://www.sohu.com/a/618731631_121123735

Guangming Daily. (2022). Hydrogen energy is the new code of modern energy systems. [Online]. [Accessed December 26 2022]. Available from: https://app.gmdaily.cn/as/opened/n/60b8075c76aa410c9db6f37884484dca

IEA. (2022). Global Hydrogen Review 2022.

Meng, X. et al. (2020). ‘Review of China's hydrogen energy policy, industry and technology development hot spots in 2019’, Science and Technology Guide, 38 (3), 12

TrendBank. (2022). Blue Book of 2022 Mobile Hydrogen Supply System Industry Development.